Full flexibility. Complete control.

Fine-tune your finances with custom spending limits, multi-step approvals and more. The best way to achieve perfect harmony between your budgets and your spending.

Powered in the UK by B4B partnership

Leading expenses tool in Europe

1480+ five star reviews

Bank-level security

FSA & PCI regulated

Trusted by more than 37,000 companies

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&dpr=2&h=60)

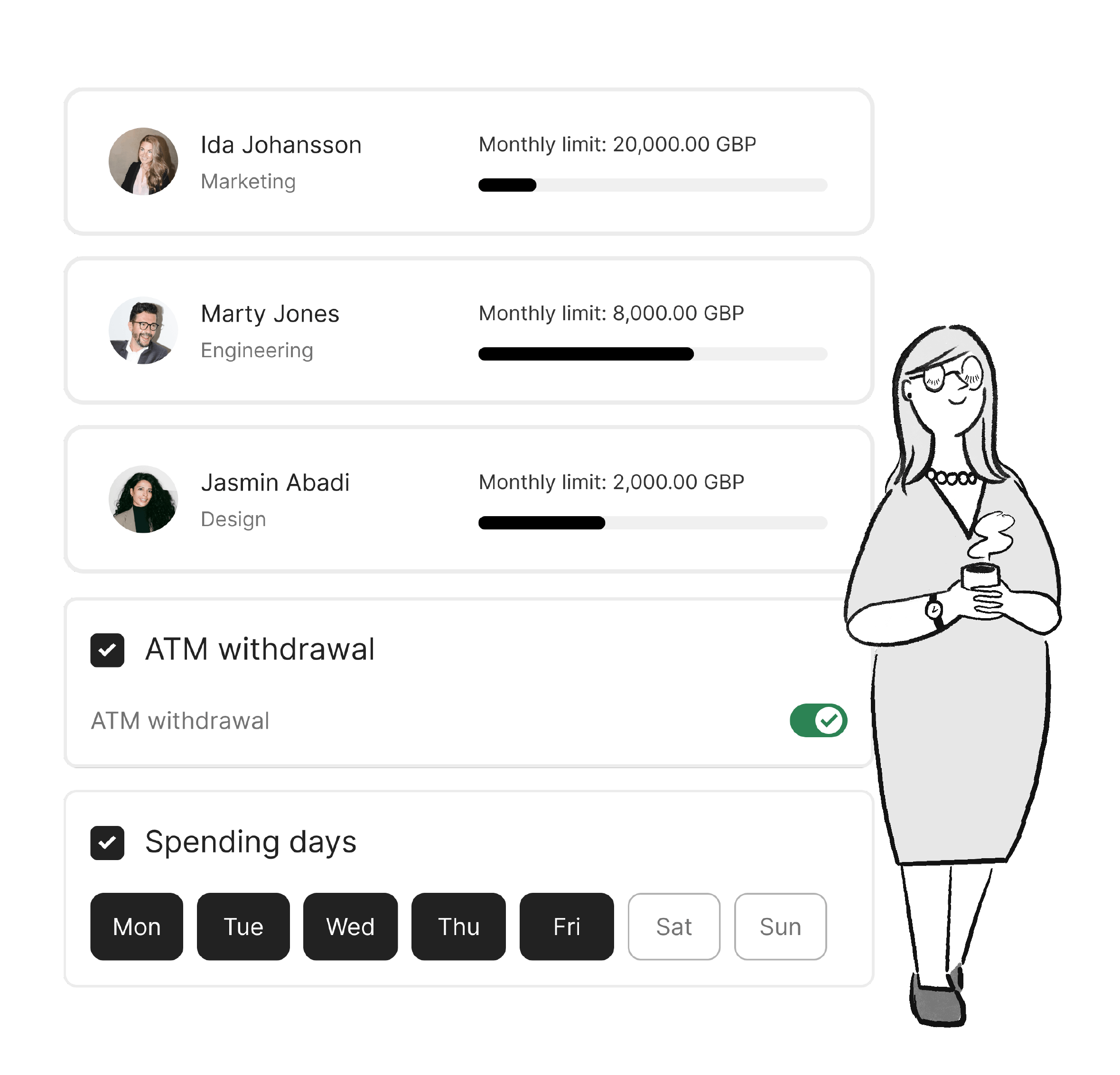

Spend controls at every corner

Your personalised set of tools to help you hit your goals while keeping company spending in check.

1

Permissions

Set guardrails to make all spend compliant. Apply customisable spending limits, vendor-specific, ATM or time-based card restrictions for every employee so you can control spending before it happens.

![]()

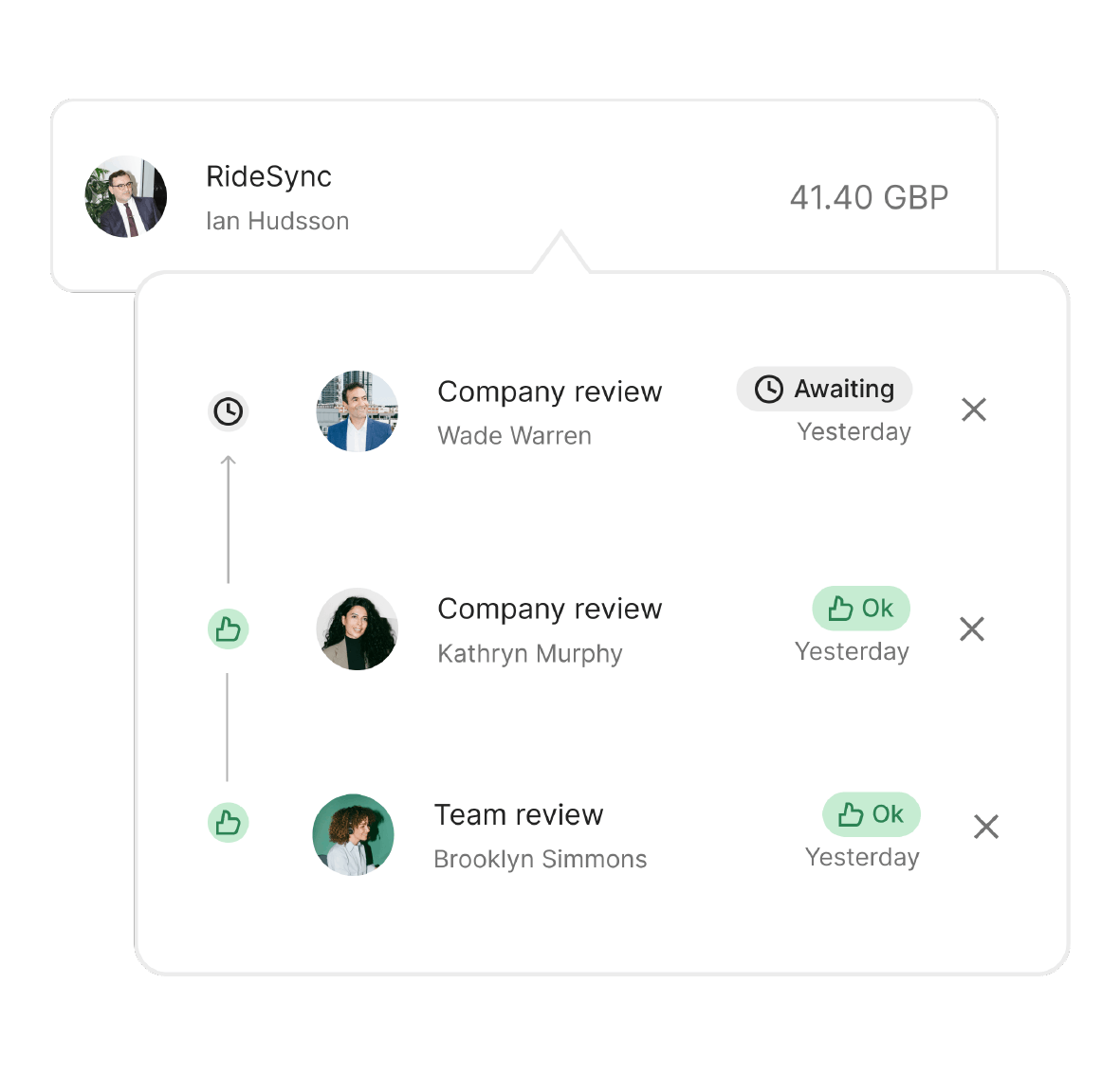

2

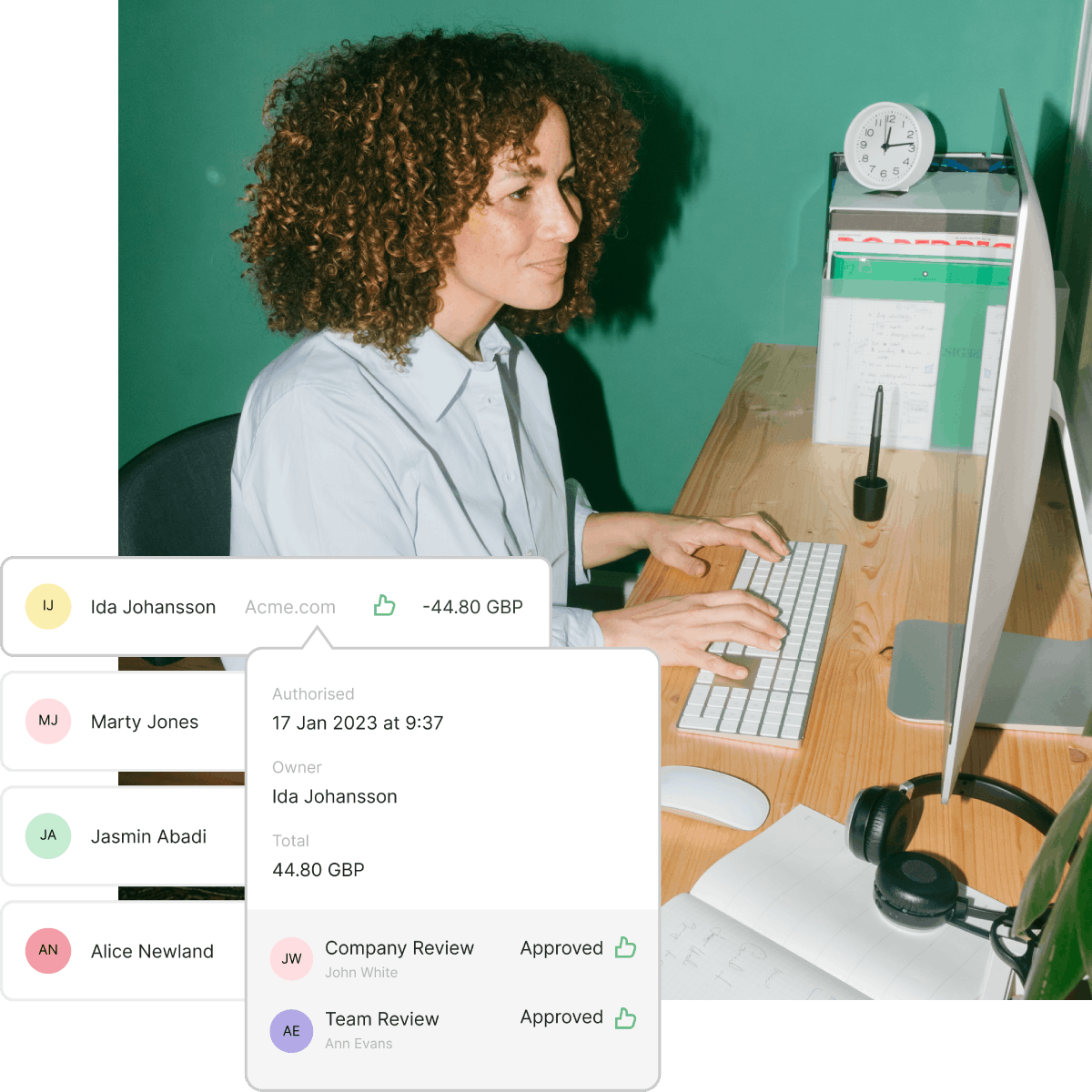

Approvals

Catch out-of-policy spending with flexible approval flows. Review and approve everything from card expenses and reimbursements to invoices all in one place without manual work and messy email threads.

![]()

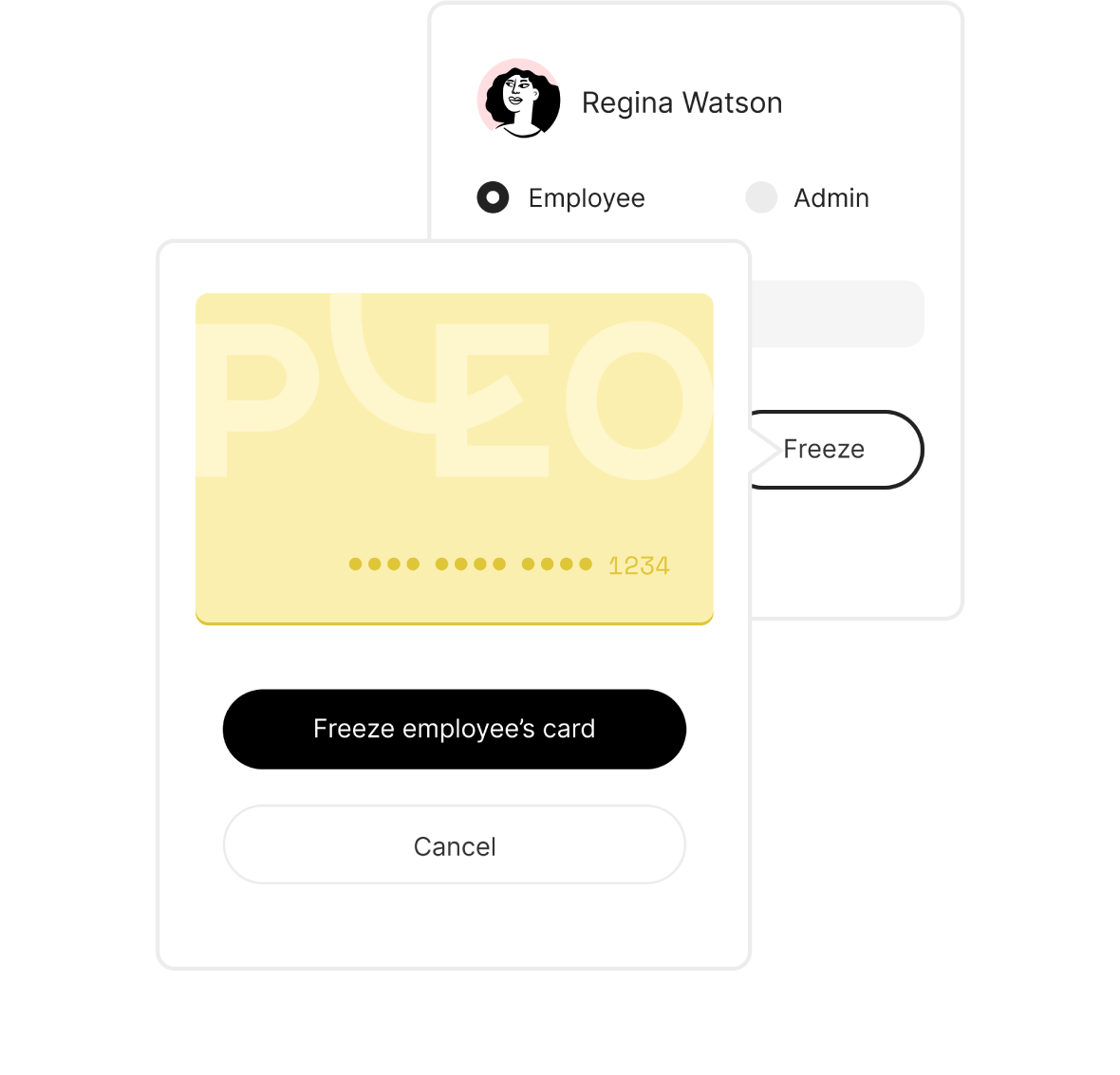

3

Protection

Noticed some unauthorised payments or potential fraud? No problem. Easily freeze Pleo cards to stop suspicious spending in its tracks. And if an employee leaves the company, block their card and remove the user from Pleo in seconds.

![]()

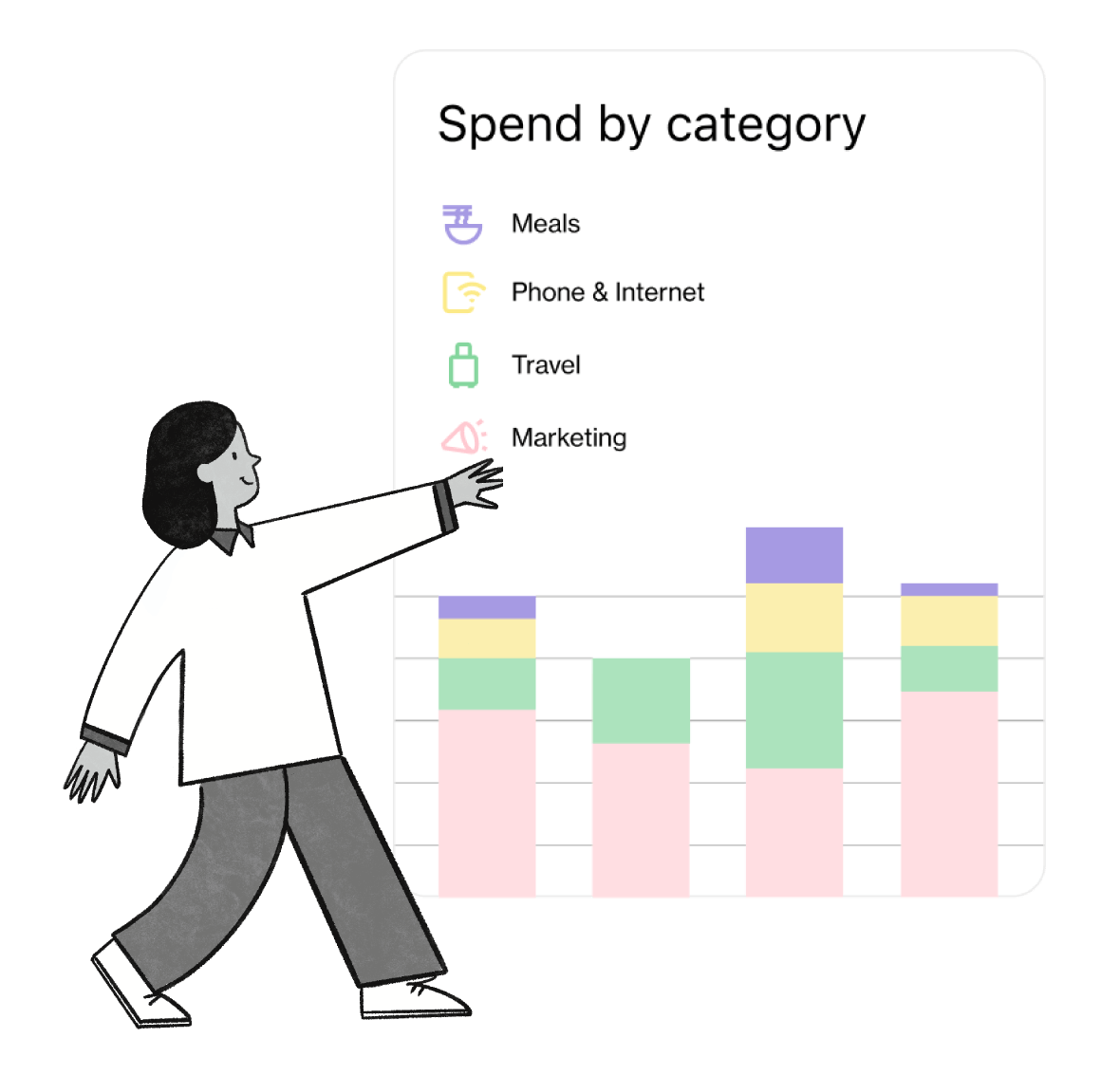

4

Visibility

You can't control what you can't see. With Pleo you can easily track all business spend in real-time. From budgets to vendor payments, Pleo gives you the insights you need to avoid overspending and uncover ways to save.

![]()

Everything you need to feel in control

Customisable limits

Tailor spending limits for each employee, from total and monthly limits, to individual purchase and temporary limits.

Pre-block ATM withdrawals

Don’t want employees taking out cash? No problem – just block cash withdrawals in your settings.

Sub-wallets

Control how funds are used by ring-fencing pots of money for specific projects or budgets.

Vendor payment controls

Get in control of duplicate recurring payments with vendor insights, renewal reminders and vendor-restricted cards to prevent overspending.

Flexible approvals

Assign the right reviewers to approve each expense and invoice, so nothing falls through the cracks.

Freeze and remove users

Spotted something suspicious or fraudulent? Freeze cards or remove users in just a few clicks.

Multi-step approvals

Choose your level of control

When it comes to expenses, one size does not fit all. With Pleo, you can set different review and approval flows to suit your business. Whether you want to assign reviewers by team, department, project, or cost center - we've got you covered. You can even add an extra layer of oversight by adding Finance team reviewers as a final step to comply with the four-eyes principle.

Budgets

Stay on track with budgets

Planning an event or project and need to closely monitor the budget? Create a budget and add tags to track all associated expenses and invoices in real-time. You'll receive a notification when 75% and 100% of the budget has been spent, in addition to if you overspend, keeping company spend neat and tidy.

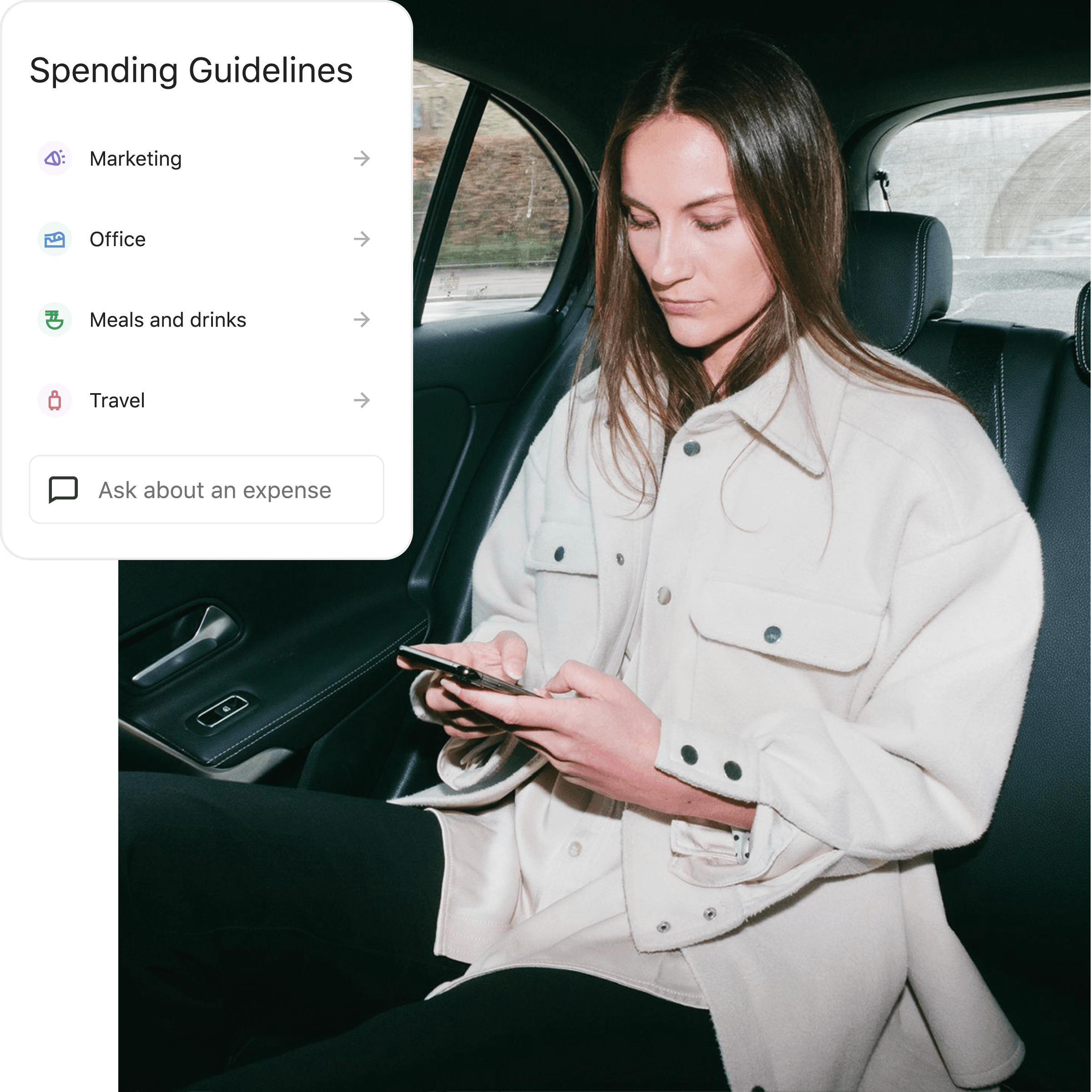

Spend Guidelines

Help employees stay within policy

Encourage good spending habits and reduce out-of-policy expenses with AI-assisted Spend Guidelines that let your employees know what they can or can't expense. With guidelines embedded in Pleo, employees can stay up to date with the latest policies to spend with confidence and always stay in-policy.

Get the full picture

Tags & categories

Track spending across your cost centers and chart of accounts to make month-end a breeze.

Budgets

Get full visibility of spending and make sure budgets stay on track to prevent overspending.

Audit trails

Stay compliant with a real-time activity log of all expenses, payments, reviews and approvals.

Analytics

See a single overview of all business spending from daily expenses to subscriptions in one place.

72%

feel they have a better overview of how company money is being spent

75%

agree Pleo has decreased time spent on admin work

69%

feel that using Pleo has increased transparency

"With the controls we could implement and automatic reminders to employees when receipts were needed, we have been able to spend our time on so many more business-critical projects."

Charlie Maynard Finance Manager, what3words

![]()

"For traditional finance departments the idea of many people having a company credit card is a bit of a scary thought, but Pleo actually makes things a lot easier and safer."

Kasper Sommer Finance Director at Planday

![]()

Highly rated in all the right places

Get started with Pleo

Join 37,000+ customers already using Pleo to stay on top of company spending. Start your free trial.

Powered in the UK by B4B partnership